£5bn tax hike will hit low earners and business - Cable

The Chancellor should have cut income tax to make the tax system permanently fairer, say the Liberal Democrats.

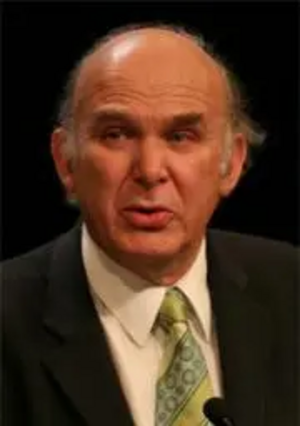

Commenting on the Pre-Budget Report, Liberal Democrat Shadow Chancellor, Vince Cable said:

"The Government acknowledges that the UK tax system is inherently unfair, but then announces that it will hit those struggling to make ends meet with yet higher tax bills by increasing National Insurance. Everyone earning over £19,000 will be hit.

"The new 45p Income Tax rate is nothing more than a fig leaf to cover a £5bn tax hike which will hit millions of low earners and businesses.

"The Government has missed a golden opportunity to make the tax system permanently fairer which it could have done by cutting income taxes for those on low and middle incomes, paid for by getting rid of tax loopholes for the wealthy.

"Instead of increasing investment in sustainable capital projects which benefit the country tomorrow as well as today, the Government has opted for a temporary cut in VAT which will benefit big spenders the most and not give the economy the boost it needs.

"At a time of economic emergency, Gordon Brown has once again failed those who need help the most."

Full text of Vince Cable's response to the statement in the House of Commons

"Perhaps I may start with some of the positive points with which we can agree: the statement on repossessions, the action on small business lending, the programme on home improvement, and the postponement of the decision on retrospective vehicle excise duty.

"This is not a normal pre-Budget statement. We are experiencing a national economic emergency, and what is required, alongside radical cuts in interest rates and radical action on bank lending, is a serious tax cut concentrating on the low paid. The Chancellor has based his plans essentially on a temporary small cut in value added tax. I note that he is relying on the advice of a former Conservative Chancellor, the right hon. and learned Member for Rushcliffe (Mr. Clarke), in that regard.

"What I fail to see is how the economy receives a major stimulus from, for example, a £5 cut in the price of a £220 imported flat-screen television or a 50p cut in a £25 restaurant bill. Surely it would be much more sensible to put money directly in the pockets of low-paid workers by cutting their income tax, rather than offering them a pathetic £25 and, if they earn over £20,000 a year, the prospect of tax increases.

"The Government have at last, after 11 years, acknowledged that there is a problem of inequality relating to the tax system. What they propose is a higher rate of tax for very high earners, after two years-possibly. What is needed, surely, is a comprehensive approach which involves cutting income tax for low-paid middle-income families and removing the vast plethora of tax reliefs and allowances from which the wealthy benefit, rather than this very limited fig leaf for redistributive policy.

"What I find wholly incredible about the statement are the assumptions that the Government make about the future trajectory of the economy. They simply assume that after one bad recession year there will be an economic recovery. Buried in the Red Book is the assumption that after next year, the public sector need make no contribution whatever to economic growth. However, the problem is a very deep one. This is not just a conventional recession. We do not just have the home-grown problem of the bursting housing bubble and personal debt; we have the imported credit crunch.

"As far as the banks are concerned, the problem is very deep. The Prime Minister tours the world, a little bit like a celebrity heart surgeon, lecturing the uninitiated on how to carry out financial heart transplants, but meanwhile the patient back here is suffering very badly, because the banks are cutting credit and greatly increasing their margins. I welcome what the Chancellor said about the Royal Bank of Scotland's announcement yesterday; that was a positive step. I do not, however, know whether he is aware that today Barclays, whose balance sheet is twice as big as the Government's entire public debt, is in the process of negotiating a deal with Arab investors on such extortionate terms that it is bound to make a drastic reduction in bank lending at the expense of its British customers. It is all very well for the Government to say that they are setting up a panel to monitor bank credit, but what is the Chancellor doing to enforce the conditions that the banks have apparently agreed to?

"I welcome some of the Government's comments on public investment, particularly on housing, but let us just consider the status of the Government's commitment on housing, with their £700 million programme of social housing. The Government have a once-in-a-lifetime opportunity. Land is available very cheaply in the current market, and they could make a programme of large-scale social housing construction, meeting housing need and providing employment in the construction industry, but despite the rhetoric and the promises, virtually nothing is currently happening. It is not happening because the housing associations are loaded with bad debt that they acquired in dodgy deals with developers, and the Treasury is blocking any fundamental reform in the housing subsidy system. Nothing is happening.

"To conclude, we have a very serious national economic crisis. The Conservatives do not acknowledge it, so they do not propose to do anything. The Government have rhetoric, but the rhetoric is not matched by their actions."